Is Hassett the next chairman of the Federal Reserve? Will this be beneficial for the crypto industry?

Deng Tong, Jinse Finance

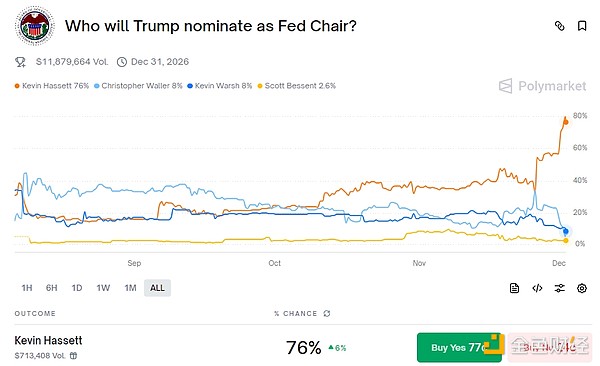

On November 30, White House National Economic Council Director Hassett stated that if U.S. President Trump nominates him as Federal Reserve Chair, he "would be very happy to serve." According to Polymarket data, the probability of Hassett being elected as Federal Reserve Chair has risen to 76%.

Who is Hassett? Will his appointment bring positive impacts to the crypto industry? Will the independence of the Federal Reserve be affected? What impact will it have on the future economy?

I. Who is Hassett?

Hassett is the Director of the White House National Economic Council and an American economist. From 2017 to 2019, he served as Senior Advisor and Chairman of the Council of Economic Advisers. During Trump’s first term, Hassett served as the 29th Chairman of the Council of Economic Advisers from September 2017 to June 2019.

Hassett joined the American Enterprise Institute (AEI) in 1997 as a resident scholar. His research areas include tax policy, fiscal policy, energy issues, and stock market investment. He has collaborated with R. Glenn Hubbard on research into budget surpluses, income inequality, and tax reform. Hassett has published papers and articles on topics such as capital taxation, tax policy consistency, returns on energy-saving investments, corporate taxes, telecommunications competition, the impact of taxes on wages, dividend taxes, and carbon taxes.

In 2003, Hassett was appointed Director of Economic Policy Studies at AEI. He has written columns for newspapers such as The New York Times, The Washington Post, and The Wall Street Journal. He writes a monthly column for National Review and, since 2005, a weekly column for Bloomberg.

In November 2024, after Trump won the election, Trump announced that Hassett would serve as Director of the National Economic Council (NEC). Politico reported that Hassett "will take on broader responsibilities, becoming the President’s senior advisor on economic affairs and playing a key role in coordinating policy and strategy across government departments." In January 2025, at the start of Trump’s second term, Hassett officially assumed the role of NEC Director.

In October 2025, U.S. Treasury Secretary Scott Besant confirmed that Hassett was one of five candidates President Trump was considering to succeed Federal Reserve Chair Jerome Powell, whose term ends in May 2026.

II. Will Hassett’s Appointment Benefit the Crypto Industry?

Despite a lack of explicit public statements, Hassett is widely regarded as a supporter of cryptocurrency. In June this year, he disclosed that he holds at least $1 million in Coinbase shares and received at least $50,001 in compensation for his role on the exchange’s Academic and Regulatory Advisory Council, making his ties to the crypto industry unusually close for a potential Fed Chair.

The National Economic Council (NEC), which he leads, oversees the development of the White House Digital Assets Working Group, which earlier this year released a document outlining the government’s cryptocurrency policy.

The Federal Reserve does not regulate securities or commodities, so its policy changes cannot directly affect cryptocurrency regulation. However, a crypto-friendly Fed could still have a positive impact on the industry in several ways.

First, lower interest rates usually mean better prices for cryptocurrencies. Juan Leon, Senior Investment Strategist at Bitwise, said the market impact would be "very positive." He described Hassett as an "aggressive dove" who has publicly criticized current high interest rates and advocated for larger and faster rate cuts.

Zach Pandl, Head of Research at digital asset investment platform Grayscale, said: "On the margin, Hassett should be seen as good news for crypto."

Caitlin Long, founder and CEO of Wyoming’s Custodia Bank and a well-known advocate for crypto-friendly regulation, pointed out: "If all this comes true and Hassett really becomes Fed Chair, then those anti-crypto figures who still hold key positions within the Fed will eventually step down (at least most of them). The Fed will undergo major changes."

The Federal Reserve also regulates banks, especially bank holding companies, access to payment systems, reserve requirements, and liquidity and risk rules. Tightening or loosening these rules could affect crypto companies’ access to various services, including:

Cryptocurrency custody;

Loans collateralized by cryptocurrency;

Access to payment channels;

Requirements for stablecoin issuers relative to banking regulations;

Settlement rules.

However, the White House has not yet officially nominated a candidate. Treasury Secretary Scott Besant announced in late October that Hassett was one of five candidates to succeed Jerome Powell. Other candidates include former Fed Governor Kevin Warsh, current Fed Governors Christopher Waller and Michelle Bowman, and BlackRock executive Rick Rieder. The final nominee is expected to be announced before Christmas.

III. Will the Independence of the Federal Reserve Be Affected?

1. The Independence of the Federal Reserve

The independence of the Federal Reserve is mainly based on three institutional arrangements:

1) Term Independence

The Fed Chair and Governors have long terms (Chair: 4 years, Governors: 14 years), much longer than the President’s term.

The President cannot dismiss the Fed Chair, only decide on reappointment at the end of the term (with very rare exceptions).

This prevents the White House from easily pressuring the Fed by replacing officials who disagree with monetary policy.

2) Financial Independence

The Fed operates independently, with income mainly from interest on U.S. Treasuries it holds and financial operations.

It does not rely on Congressional appropriations, so neither the executive nor legislative branches can influence its decisions through the budget.

3) Decision-Making Independence

Monetary policy is determined by the FOMC (Federal Open Market Committee).

No approval is needed from the President or Treasury Department.

The Council on Foreign Relations has praised the Fed’s independence, stating that it "protects the Fed from undue political influence, such as White House pressure to lower interest rates before an election, which may bring short-term political gain but cause long-term economic harm."

The Fed’s independence also "enhances its credibility," giving markets more confidence in its decisions. "Crucially, it also empowers the Fed to take tough but necessary actions, even when those actions are unpopular."

2. Is Hassett a Political Loyalist?

However, since taking office, Trump has sought to strengthen control over the Fed to exert greater influence on his preferred monetary policy.

Earlier this year, he attempted to fire Fed Governor Lisa Cook. Cook refused to resign, and the case was ultimately appealed to the Supreme Court, which currently allows her to remain in office. In documents submitted to the court, Cook’s lawyer Abbe Lowell called the attempt "a fierce attack on the Fed’s century-long independence."

In the eyes of supporters, Hassett is an outstanding policymaker. As his longtime ally and former Trump advisor Stephen Moore said, he is a "hard currency" expert who will defend the dollar. However, in the view of some former colleagues, as a presidential advisor, he has become a more worrying figure: a political loyalist willing to sacrifice institutional independence and objective truth to please his boss.

This time, Hassett has become one of Trump’s staunchest economic supporters. He pointed out that if he were now in charge of the Fed, he would "cut rates immediately" because "the data show we should do so." He also predicted that Trump’s reduction of domestic factory corporate tax rates and the introduction of new industrial policies would lead to "absolutely breakthrough" growth in GDP and employment in 2026.

He has also echoed Trump’s attacks on the Fed and the statistics it relies on: accusing Fed officials of "putting politics above duty"; saying the Fed is "slow to cut rates"; and suggesting that employment data released by the Bureau of Labor Statistics shows a partisan "pattern." When Trump fired BLS Director Erica McEntarfer and accused her of "manipulating" data, a smiling Hassett described the move on television as being for accuracy and procedural reasons.

Hassett has become a regular on cable news, defending Trump’s policy priorities, downplaying negative data, and echoing the White House’s stance on everything from inflation to the legitimacy of federal statistics. In early November, the NEC Director insisted that inflation had "fallen sharply" and that price trends were "very good," even though official data showed the Consumer Price Index had risen for five consecutive months.

John Authers, Senior Editor for Markets and columnist at Bloomberg, wrote that the choice of Hassett "seems to be about loyalty. Trump believes that nominating Jerome Powell eight years ago was a huge mistake. Waller, Warsh, and Rieder could all establish their independence from the administration in different ways."

George Pollack, Senior U.S. Policy Analyst at Signum Global Advisors, said Trump nominated Hassett "because he believes Hassett is the candidate most likely to support this administration’s priorities."

If the Fed becomes just another branch of government, it may benefit the crypto market in the short term, but could have disastrous consequences in other areas. Interest rates below what is actually needed may win cheap political capital but will lead to increased inflation.

The Center for American Progress explained: "Interest rates will be based on well-researched data, not political whims, which assures the world that the U.S. economy will remain relatively stable and its markets will remain rational."

IV. Impact on the Future Economy

Jon Hilsenrath, Senior Advisor at StoneX and former Wall Street Journal Fed reporter, pointed out that the immediate rise in 10-year U.S. Treasury yields is significant.

He posted on LinkedIn that higher yields indicate bond traders are betting that a Fed led by Hassett may take a more dovish approach to inflation, thus requiring higher long-term yields to compensate for this risk. While yields near 4% may seem acceptable, given that inflation remains above the Fed’s 2% target and the budget deficit is close to $2 trillions, this yield is actually "abnormally low." If the bond market loses confidence in the Fed’s independence, this disconnect could trigger a violent market reaction and cause rates to soar.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Bitcoin valuation metric projects 96% chance of BTC price recovery in 2026

Bitcoin's ‘more reliable’ RSI variant hits bear market bottom zone at $87K

XRP ETF inflows exceed $756M as bullish divergence hints at trend reversal