PIPPIN Defies the Market, Turning $180,000 Into Over $1.5 Million for a Trader

While the broader crypto market flashed red in early December, a Solana-based meme coin called PIPPIN delivered a remarkable countertrend rally. Its rapid price surge enabled several traders to achieve massive short-term profits. However, it also raised concerns about a potential sharp correction that could hurt latecomers. How One Trader Made More Than $1.3 Million

While the broader crypto market flashed red in early December, a Solana-based meme coin called PIPPIN delivered a remarkable countertrend rally.

Its rapid price surge enabled several traders to achieve massive short-term profits. However, it also raised concerns about a potential sharp correction that could hurt latecomers.

How One Trader Made More Than $1.3 Million With PIPPIN

PIPPIN originated from an AI-generated unicorn image (SVG). It later evolved into a meme coin on Solana.

Unlike many other meme tokens, the project’s developers promised to release open-source tools with potential applications for PIPPIN, including interactive tutoring systems, AI marketing assistants, and personality-driven DevOps bots capable of writing and deploying code.

Despite its high-risk meme-coin nature, PIPPIN has become one of the most talked-about names in Solana’s meme wave at the end of 2025.

PIPPIN Price Performance. Source:

PIPPIN Price Performance.

PIPPIN Price Performance. Source:

PIPPIN Price Performance.

According to data from BeInCrypto, the token has experienced a surge of over 400% in the past month and is currently trading at $0.139. When comparing the low in November ($0.02) to the recent high ($0.20), the token has increased tenfold. Additionally, the daily trading volume has surpassed $120 million, a significant rise from under $10 million in November.

This rally has put one early buyer on enormous unrealized profits. According to market-tracking account LookOnChain, a wallet named BxNU5a was created about a month ago. The wallet spent $179,800 to acquire 8.2 million PIPPIN tokens. The current value of this stash is approximately $1.51 million, resulting in an unrealized gain of more than $1.35 million.

A month ago, someone created a new wallet, BxNU5a, and spent $179.8K to buy 8.2M $pippin($1.51M now).This guy is now sitting on over $1.35M in unrealized profits.

— Lookonchain (@lookonchain) December 1, 2025

Nansen also reported strong whale accumulation and a sharp increase in the number of active wallets, signaling a wave of new investors pouring money into the token.

“PIPPIN didn’t just ‘go up,’ it detonated. 437% in 7 days with $43.9M volume is a different tempo. Whales added +6.6M, fresh wallets put in +11M, and exchanges saw sharp outflows,” — Nansen.

These bullish signals have fueled hopes that PIPPIN could become the next standout in the Solana meme-coin ecosystem. Recent reports also highlight potential reasons why the meme-coin wave may return in December.

Warning Signs Emerge

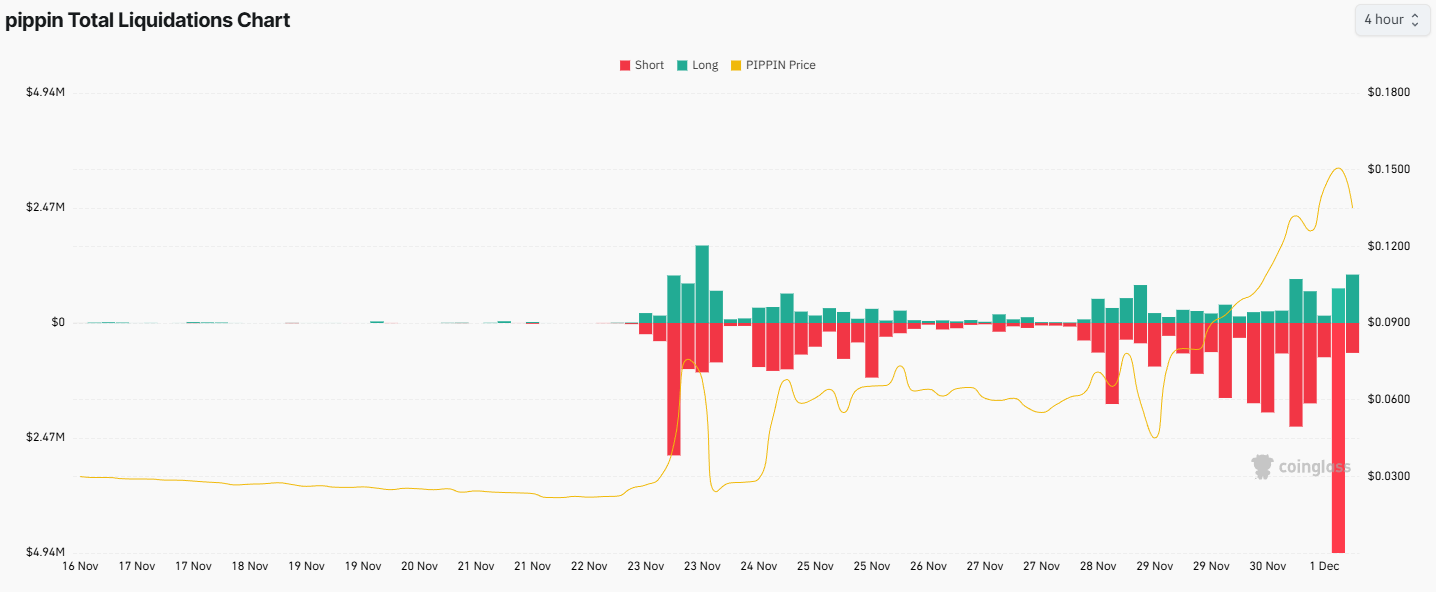

Despite the explosive rally, significant risks have also surfaced. The first warning concerns PIPPIN’s short positions suffering heavy liquidations.

Data from Coinglass shows a series of short positions being wiped out during the last week of November. The heaviest liquidation day occurred on December 1.

Pippin Total Liquidations. Source:

Pippin Total Liquidations.

Pippin Total Liquidations. Source:

Pippin Total Liquidations.

Coinglass reported more than $15 million in liquidations on December 1 alone, with over $11 million coming from short positions.

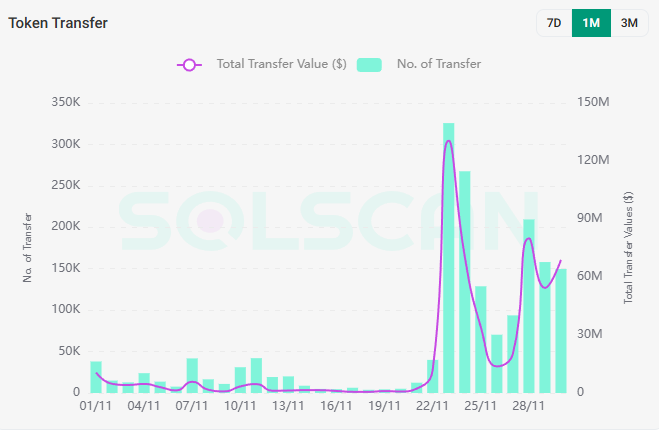

On-chain signals are also flashing caution. According to Solscan, even as the price soared, real on-chain trading volume decreased by 45% compared to the previous week.

PIPPIN Token Transder. Source:

PIPPIN Token Transder.

PIPPIN Token Transder. Source:

PIPPIN Token Transder.

Traders are executing fewer transactions on-chain and shifting more activity to exchanges. This divergence could signal a sharp decline if increasing amounts of PIPPIN are sold on centralized platforms.

Well-known analyst Altcoin Sherpa compared PIPPIN to other meme tokens, such as AVA, GRIFFAIN, and ACT, predicting that prices may drop significantly soon.

“With PIPPIN moving, some of these other AI shitters are also going. AVA, GRIFFAIN, ACT. Hard to honestly trade them though, and these are probably just 24-hour pump-and-dumps for most of them. Unlikely to be a sustained pump,”— Altcoin Sherpa.

PIPPIN’s market cap previously reached over $300 million late last year before collapsing to $8 million, which adds to investor skepticism about another potential steep dump.

Another analyst described PIPPIN’s rally as a familiar pattern: a small group accumulates heavily and withholds supply, creating buy pressure that pushes the price up. Short positions are then liquidated, the price drops afterward, and the cycle repeats.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Buzz Around Momentum (MMT) Token: Could This Be the Next Major Opportunity in Crypto Investments?

- Momentum (MMT) token surged 4,000% post-2025 TGE, driven by exchange listings and speculative demand, despite a 70% correction. - Institutional adoption accelerated by $10M HashKey funding and regulatory frameworks like MiCAR, while Momentum X targets RWA tokenization. - Retail investors face volatility risks from leveraged trading and token unlocks, contrasting institutions' focus on compliance and stable exposure. - Technical indicators show mixed outlook, with RSI suggesting potential bullishness but

Tech Learning as a Driver of Progress in 2025

- Global demand for AI, cybersecurity, and data science education drives enrollment surges, with U.S. AI bachelor's programs rising 114.4% in 2025. - Institutions innovate through interdisciplinary STEM programs and digital ecosystems, addressing workforce gaps with AI ethics and immersive tech integration. - Education-tech stocks gain traction as hybrid learning models and AI-driven platforms align with $4.9 trillion digital economy growth and rising cybersecurity job demand. - Federal funding challenges

TWT's Tokenomics Revamp for 2025: Supply Structure Adjustment and Lasting Value Impact

Aster DEX: Connecting Traditional Finance and DeFi by Streamlining Onboarding and Encouraging Institutional Participation

- Aster DEX bridges TradFi and DeFi via a hybrid AMM-CEX model, multi-chain interoperability, and institutional-grade features. - By Q3 2025, it achieved $137B in perpetual trading volume and $1.399B TVL, driven by yield-bearing collateral and confidential trading tools. - Institutional adoption surged through compliance with MiCAR/CLARITY Act, decentralized dark pools, and partnerships with APX Finance and CZ. - Upcoming Aster Chain (Q1 2026) and fiat on-ramps aim to enhance privacy and accessibility, pos