ETH Gas Limit Jumps to 60M and the Timing Is Wild

Ethereum just took a major step forward, and the timing couldn’t be more deliberate. The network has quietly bumped its block gas limit from 45 million to 60 million, giving the base layer far more breathing room right as ecosystem throughput hits new highs and the Fusaka upgrade sits days away. This isn’t a random tweak. It’s a coordinated shift in how Ethereum wants to scale, and the ripple effects are already visible across L2s, developers, and the wider rollup economy.

Why the Ethereum Gas Limit Jump Matters

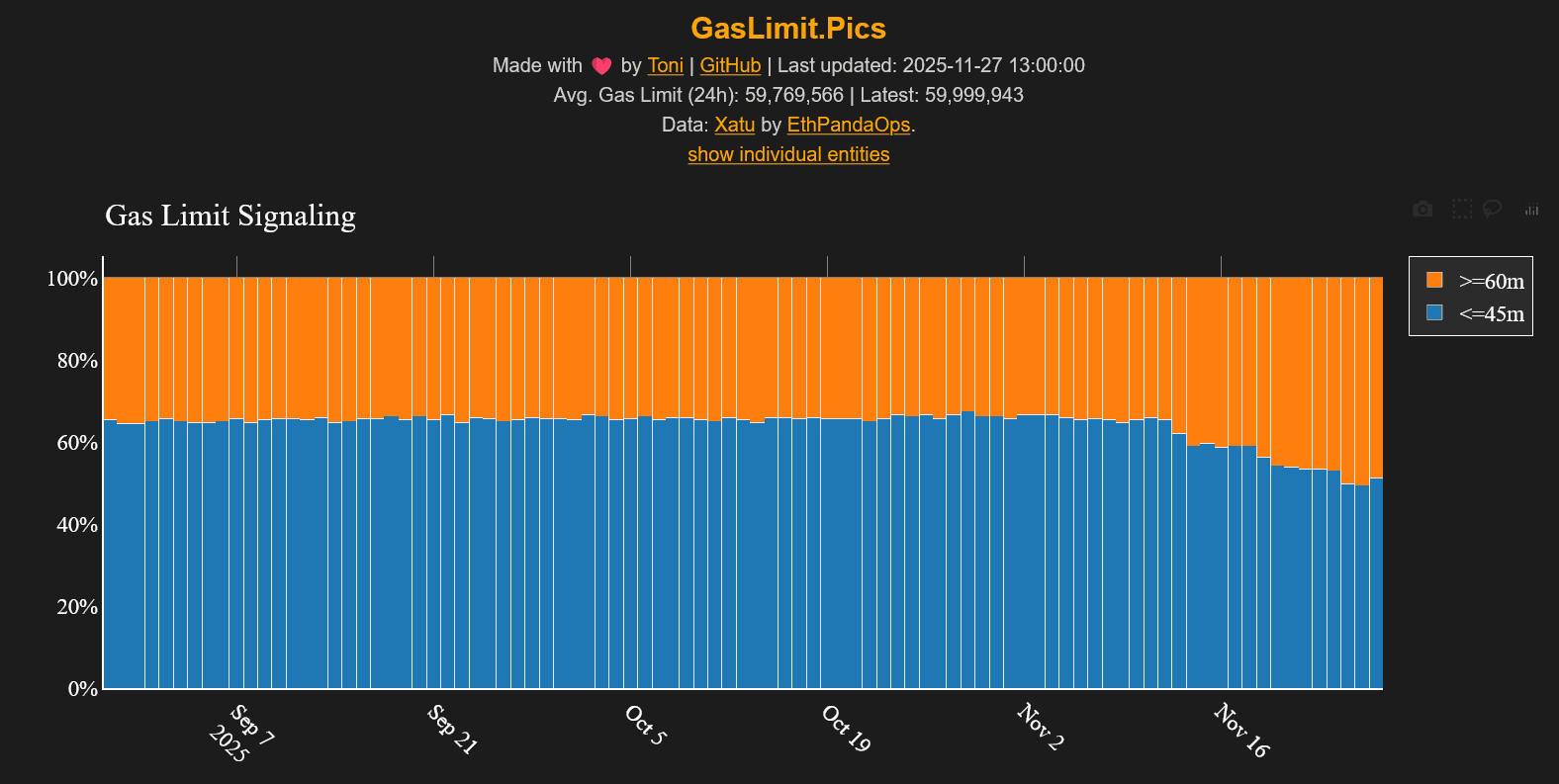

Ethereum has always treated the Ethereum gas limit like a pressure valve. Push it too far and you risk clogging the network or stressing clients. Keep it too low and you throttle innovation. The move from 45M to 60M is the biggest increase in years, and it happened only after more than half of validators signaled approval, triggering an automatic network-wide switch on November 25.

This change didn’t appear overnight. Toni Wahrstätter from the Ethereum Foundation called it the result of a long, steady community push that started a year ago. In his words, Ethereum is now running at double the gas limit it had last year, and this is only the beginning.

For developers and DeFi users, the impact is simple: blocks can now fit more transactions. That means higher base-layer throughput, fewer peak-hour bottlenecks, and more breathing room as L2s continue to scale.

What Made the Increase Possible?

If you zoom out, the increase is the result of three major forces converging at the right moment.

First, EIP-7623 added new block-size safeguards at the protocol level, reducing risks tied to runaway block growth. Second, major clients have been optimized across the board. That means Geth, Nethermind, Besu, and others can now handle heavier gas loads without slowing block propagation. Finally, long stretches of testnet trials have shown something everyone wanted to see: stable behavior even under heavier load.

Independent researcher Zhixiong Pan highlighted this combination as the reason Ethereum can now pursue more “aggressive L1 scaling” without gambling on network stability. And he’s right. Ethereum has rarely been this aligned on both engineering readiness and real-world conditions.

Vitalik’s Take: Not Just Bigger Blocks, Smarter Scaling

Vitalik Buterin added an interesting layer to the conversation. Yes, the gas limit is higher. But he argued the future isn’t simply about making blocks as big as possible. Instead, he sees the next wave of scaling as more targeted.

What this really means is that future upgrades could raise the gas limit again but pair it with higher gas costs for specific heavy operations. Complex precompiles, expensive arithmetic, specialized contract calls — all of these could be priced higher to keep the network efficient as effective block sizes grow.

This is Ethereum stepping away from blunt scaling and moving toward fine-tuned optimization. Bigger blocks where it helps. Higher costs where it’s safer.

Rollups Are Pushing Throughput Records

The gas-limit increase lands during a record-beating moment for Ethereum’s scaling networks. Over the past 24 hours, Ethereum’s combined rollup ecosystem has processed around 31,000 transactions per second. That’s not a typo — 31,000 TPS.

Lighter, a perpetuals-focused zero-knowledge rollup with about 1.2 billion dollars locked, led the pack at nearly 5,455 TPS. Coinbase’s Base contributed 137 TPS, while a long tail of ZK and optimistic rollups filled in the rest.

This kind of throughput shows where Ethereum’s real growth is coming from. L2s are exploding, and the base layer is now being tuned to support that expansion.

Fusaka Is Around the Corner

All of this leads to the upcoming Fusaka hard fork, targeted for December 3 . The update has already gone live on major testnets and even launched a two-million-dollar audit contest. Fusaka isn’t a small upgrade. It’s a foundational shift.

At the center sits PeerDAS, a redesign of how data availability sampling works. Vitalik has called PeerDAS essential for Ethereum’s long-term scaling goals, especially for rollups that depend on fast, reliable data throughput. It’s meant to make L2 block publication smoother, more predictable, and far more efficient.

Fusaka will also deliver client updates, consensus tweaks, security improvements, and a raft of low-level refinements that tighten the engine under Ethereum’s hood.

What This All Signals for Ethereum’s Future

Put it together and a clear picture emerges. The gas-limit increase is not a one-off move. It’s a signal of confidence — that clients are ready, testnets are stable, and L2s are hungry for more room. With PeerDAS arriving in days, $Ethereum is effectively widening the base layer at the exact moment its rollup ecosystem is hitting new speed records.

The story here isn’t just about bigger blocks. It’s about a network preparing for its next era of scaling with a mix of engineering discipline, community alignment, and real-world demand.

If this is the pre-Fusaka phase, the post-Fusaka landscape is going to be even more interesting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve's Change in Policy and Its Effects on High-Yield Cryptocurrencies Such as Solana: Rethinking Risk Management Amidst Shifting Regulations in the Digital Asset Sector

- Fed's 2025 policy shift injected $72.35B into markets, briefly boosting Solana (+3.01%) before macro risks triggered a 6.1% price drop. - EU MiCA and US GENIUS Act regulations drove institutional adoption of compliant platforms, with Solana's institutional ownership reaching 8% of supply. - Fed's $340B balance sheet reduction and SIMD-0411 proposal exposed crypto liquidity fragility, causing 15% market cap decline and 4.7% TVL drop for Solana. - Institutions now prioritize MiCA-compliant stablecoins and

Algo slips 0.52% as Allego unveils app designed to simplify EV charging

- Algo (ALGO) fell 0.52% in 24 hours to $0.1335, with a 60.3% YTD decline, coinciding with Allego's new EV charging app launch. - Allego's app offers real-time pricing, smart routing, and Plug&Charge features to simplify European EV charging across 35,000+ stations. - The app eliminates partner network markups and provides transparent billing, targeting user frustrations with fragmented charging experiences. - As Europe's EV market grows, Allego positions itself as a key infrastructure provider through thi

Exploring How Artificial Intelligence Shapes Higher Education and Tomorrow’s Job Market: Supporting STEM and Technical Training to Counteract the Effects of Automation

- AI is reshaping global economies, forcing higher education and vocational programs to rapidly adapt to automation-driven workforce demands. - Institutions prioritize "AI fluency" across disciplines, while STEM/vocational training addresses growing demand in AI-augmented roles like data analysis and software development. - OECD projects AI education investments could boost GDP, with the AI education market expected to grow from $7.05B in 2025 to $112.30B by 2034. - Federal funding initiatives and private

The Growing Need for AI Professionals and How It Influences Technology Company Valuations

- Global AI talent demand surged in 2025, driving universities to expand AI curricula and industry partnerships. - Top institutions like MIT and Stanford prioritize ethical AI education, while international schools like Nanyang Tech boost AI research. - Universities with AI-focused endowments achieved 14-15.5% returns in 2025, outperforming traditional education assets. - Education ETFs like Leverage Shares +3x Long AI ETP rose 120% in 2025, tracking AI infrastructure growth and semiconductor demand. - AI