Chainlink's LINK Tumbles 4% as Selling Pressure Mounts

The native token of oracle network Chainlink LINK$21.80 encountered substantial institutional selling pressure over the 24-hour trading session, tumbling to its weakest price in more than a week.

LINK tumbled 4% to a session low of $21.30, reversing over 8% from Monday's local high, CoinDesk data shows. The decline happened in line with weakness in the broader crypto market. The CoinDesk 20 Index, a benchmark for that broader market market, was also down around the same amount.

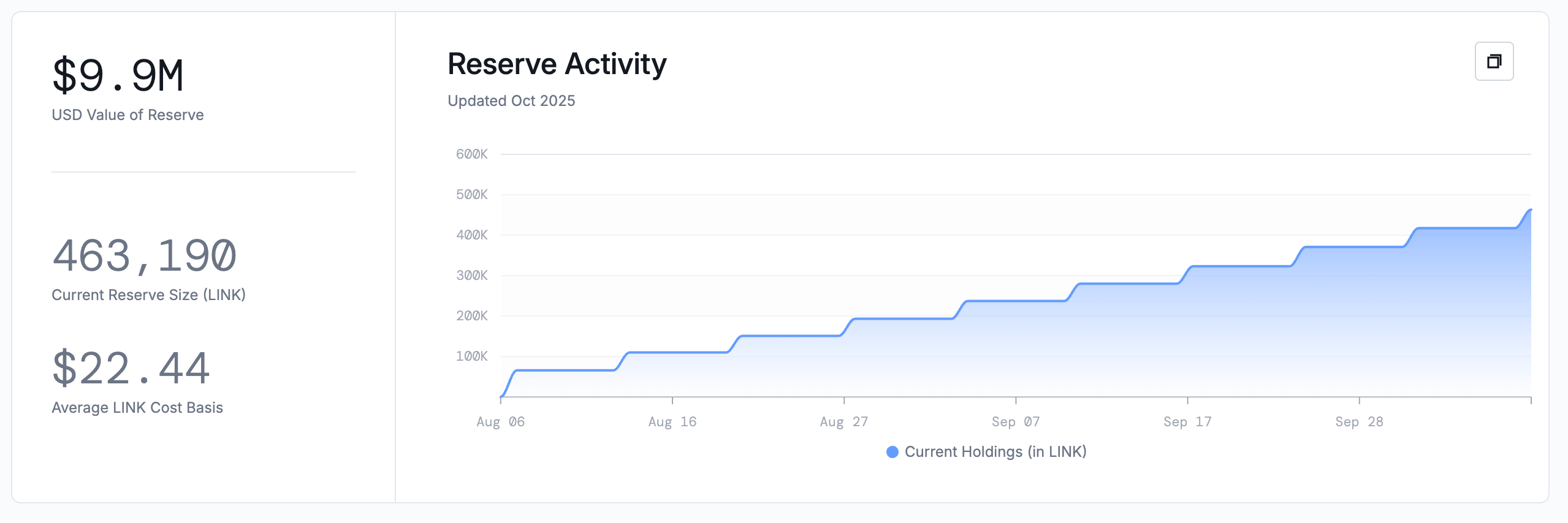

Meanwhile, the Chainlink Reserve, a facility that purchases tokens on the open market using income from protocol integrations and services, kept its weekly habit, buying another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently holds nearly $10 million worth of tokens.

Thursday's decline, however, meant that the vehicle is now underwater with LINK trading below the average cost basis of $22.44, the dashboard shows.

Key technical indicators

CoinDesk Research's technical model pointed out bearish momentum, underscoring the weakening investor sentiment.

- The token's trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and peak of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course on exceptionally heavy volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Don't be fooled by the rebound! Bitcoin could retest the lows at any time | Special Analysis

Analyst Conaldo reviewed bitcoin’s market performance last week using a quantitative trading model, successfully executing two short-term trades with a total return of 6.93%. The forecast for this week is that bitcoin will continue to fluctuate within a range, and corresponding trading strategies have been formulated. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being updated and iterated.

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage