Expect a Strong Move Up for One BNB Chain Ecosystem Altcoin, According to Economist Alex Krüger

A popular economist believes that one altcoin project supported by the BNB Chain ecosystem is setting the stage for a massive breakout.

In a new X post to his 215,200 followers, Alex Krüger says that Plasma ( XPL ) is likely to have an explosive move to the upside once the token forms a local bottom.

Plasma is a proof-of-stake (PoS) layer-1 project optimized for large-scale stablecoin payments and compatible with Ethereum ( ETH ).

“Seeing widespread FUD (fear, uncertainty and doubt) around Plasma following its two-day ~40% price correction. Dump is driven by profit taking from unlocked participants who are/were up about 20x-30x in under four months, in size.

Abnormally high funding can be indicative of spot selling. Expect a strong move up as soon as indiscriminate spot selling subsides, whenever that may be.”

Source: Alex Krüger/X

Source: Alex Krüger/X

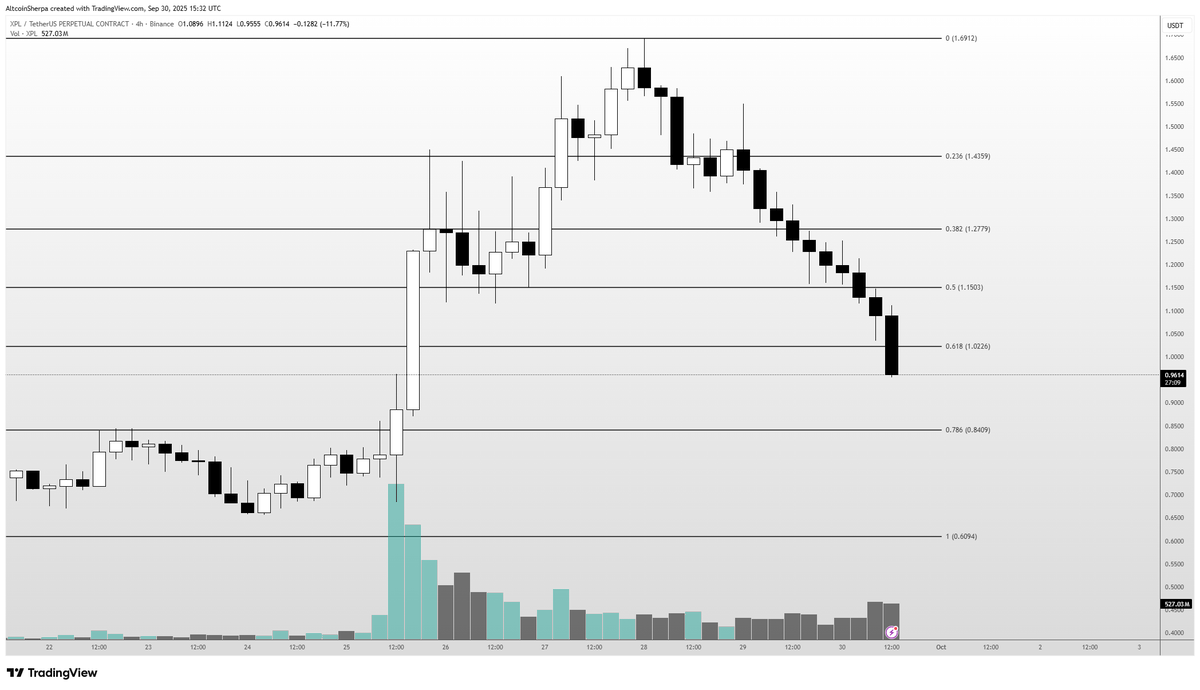

Popular analyst Altcoin Sherpa is also predicting an XPL bounce, but warns the altcoin may still have a deeper correction.

“This XPL chart is a sight to behold. Literally not one green four-hour candle and just vicious selling across the board. Seems like 90% of CT (crypto Twitter) is down on this coin, myself included.

My entry is around $1.15-$1.20 or so and I’m definitely feeling the pain. I keep thinking bounce is coming but I don’t know when/where/how it happens. I’ve already cut my perps position and just in spot at this point.”

Source: Altcoin Sherpa/X

Source: Altcoin Sherpa/X

XPL is trading for $0.95 at time of writing, down 8.2% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving and Its Impact on the Market: Supply Disruptions and Investor Attitudes in the Aftermath of Halving

- Zcash's 2025 halving cut block rewards by 50%, reducing annual inflation to 2% and reigniting debates on its privacy-focused role. - Institutional adoption grows with $151.6M Grayscale Trust and Zcash ETF proposals, balancing privacy with regulatory compliance. - Post-halving volatility saw ZEC surge 1,172% then plummet 96% in 16 days, exposing liquidity risks in its $10.3B market cap. - 70% of ZEC transactions now use shielded pools, but EU MiCA regulations and concentrated ownership create adoption unc

EU initiates antitrust investigation into Google's artificial intelligence search features

Microsoft plans to pour $17.5B into India by 2029 as competition in AI intensifies

Google’s inaugural AI-powered glasses are anticipated to launch in the coming year