Bitcoin Distribution Exposed: Few Holders Control the Majority

Bitcoin has become an increasingly prominent part of global finance. Some governments, companies, and funds now include it in their reserves, while many individuals continue to grow their holdings. On the surface, ownership appears widespread, with more than 54 million Bitcoin addresses recorded on the blockchain. However, a closer look shows that these numbers can be misleading, as they do not fully reflect who actually controls the asset.

In brief

- Fewer than 20,000 wallets hold over 60% of all Bitcoin, showing how concentrated ownership really is.

- Institutional wallets including exchanges, custodians, and miners control a large portion of Bitcoin on behalf of multiple clients.

- After filtering out tiny balances and pooled accounts, around 3.9 million active users remain who control the majority of Bitcoin outside institutions.

Whales and Institutions Dominate Bitcoin Ownership

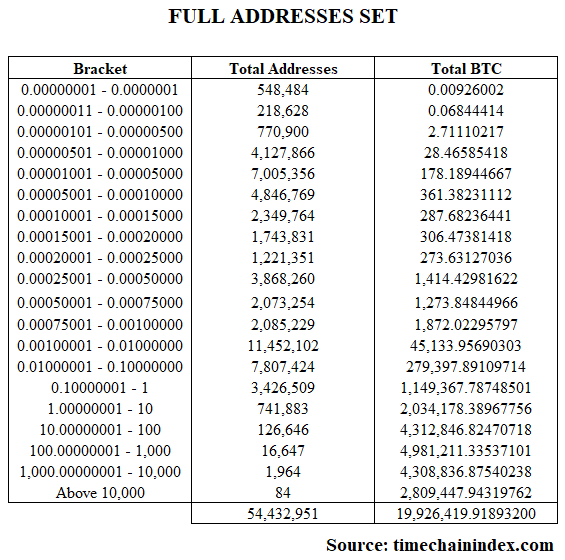

Sani, founder of the analytics platform Time Chain Index, reviewed blockchain data to measure how ownership is distributed. His analysis revealed that most of the supply is concentrated in the hands of a very small group. Out of the total addresses, only 18,695 are classified as whale wallets, but together they control more than 60% of all Bitcoin in circulation.

A significant portion of addresses also belong to institutions rather than individual users. Of the 54.4 million addresses, about 271,883 are linked to exchanges, custodians, companies, ETFs, and miners. Together, these pooled wallets hold around 8,789,113 BTC, or roughly 44% of the total supply. Since they represent funds stored on behalf of many clients, they do not reflect individual ownership.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Filtering the Data Reveals the True Bitcoin User Base

After removing institutional and pooled wallets, the remaining addresses still reveal how Bitcoin is distributed and which holdings are significant

- The leftover addresses collectively held 11,137,306 Bitcoin, though many contained only very small fragments from earlier transactions.

- To focus on meaningful balances, Sani excluded wallets holding less than 0.001 Bitcoin and also removed those linked to companies and custodians.

- This refinement left 23.43 million addresses, which together controlled 11,131,336 Bitcoin, highlighting the bulk of holdings outside large pooled accounts.

Based on this filtered dataset, Sani noted that the total number of wallets does not reflect the number of individual users , since most people control multiple addresses. Taking an average of six addresses per person, he estimated the network likely has around 3.9 million active users, who collectively hold the majority of Bitcoin outside institutional wallets.

This shows that the raw figure of 54 million addresses creates a distorted picture of adoption. While whales hold a dominant share and custodians manage nearly half the supply, the filtered dataset gives a more accurate view of genuine network participation. Even then, the actual user base is far smaller than the headline address count suggests.

Market Trends Signal Caution Amid Price Gains

Meanwhile, Bitcoin is trading around $111,000, up about 2% in the past 24 hours. Glassnode recently reported that the Accumulation Trend Score has softened , reflecting a more cautious approach from larger holders.

If demand does not pick up, the market could face additional pressure from available Bitcoin supply, leaving prices exposed in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investment Prospects in AI-Powered Training Platforms: A 2025 Overview of Industry Growth and Workforce Needs

- AI integration in education and workforce training has reached a critical inflection point, driven by surging corporate adoption and labor market shifts. - AI-powered platforms are bridging skill gaps through personalized learning, with 77% of companies using AI for training and a $240B global eLearning market projected by 2025. - Labor trends show AI displacing 92M jobs but creating 170M new roles by 2030, while AI-exposed industries grow revenue 3x faster than non-AI sectors. - Academic programs and $1

The Federal Reserve's Change in Policy and Its Effects on High-Yield Cryptocurrencies Such as Solana: Rethinking Risk Management Amidst Shifting Regulations in the Digital Asset Sector

- Fed's 2025 policy shift injected $72.35B into markets, briefly boosting Solana (+3.01%) before macro risks triggered a 6.1% price drop. - EU MiCA and US GENIUS Act regulations drove institutional adoption of compliant platforms, with Solana's institutional ownership reaching 8% of supply. - Fed's $340B balance sheet reduction and SIMD-0411 proposal exposed crypto liquidity fragility, causing 15% market cap decline and 4.7% TVL drop for Solana. - Institutions now prioritize MiCA-compliant stablecoins and

Algo slips 0.52% as Allego unveils app designed to simplify EV charging

- Algo (ALGO) fell 0.52% in 24 hours to $0.1335, with a 60.3% YTD decline, coinciding with Allego's new EV charging app launch. - Allego's app offers real-time pricing, smart routing, and Plug&Charge features to simplify European EV charging across 35,000+ stations. - The app eliminates partner network markups and provides transparent billing, targeting user frustrations with fragmented charging experiences. - As Europe's EV market grows, Allego positions itself as a key infrastructure provider through thi

Exploring How Artificial Intelligence Shapes Higher Education and Tomorrow’s Job Market: Supporting STEM and Technical Training to Counteract the Effects of Automation

- AI is reshaping global economies, forcing higher education and vocational programs to rapidly adapt to automation-driven workforce demands. - Institutions prioritize "AI fluency" across disciplines, while STEM/vocational training addresses growing demand in AI-augmented roles like data analysis and software development. - OECD projects AI education investments could boost GDP, with the AI education market expected to grow from $7.05B in 2025 to $112.30B by 2034. - Federal funding initiatives and private