Bitcoin Price Drops Amid Tariff Tensions and Fed Silence

- Bitcoin drops under $115K as Trump’s new tariff order sparks broad investor risk aversion.

- Over $600M in crypto liquidations hit the market amid Fed silence and macro uncertainty.

- Market volatility increases as Bitcoin dips, spooked by macroeconomic policy uncertainty.

Bitcoin slipped below $115,000 on Friday morning after investors reacted to trade tensions and monetary policy uncertainty. The drop came hours after U.S. President Donald Trump signed an executive order on global trade tariffs while simultaneously, the U.S. Federal Reserve held back from signaling any rate cuts, adding to market anxiety.

Bitcoin fell to $114,418 during early trading in Asia, its lowest level since June 11. This marked a 2.6% daily loss and pushed Bitcoin 6.3% below its July 14 all-time high of $122,800. The decline also broke Bitcoin’s three-week consolidation channel, signaling a possible shift in short-term momentum.

Source: TradingView

Trade Tensions and Policy Silence Add Pressure

President Trump’s executive order formalized several new tariffs on countries that failed to reach trade agreements. Countries like South Africa, Switzerland, Taiwan and Thailand face 19% to 39% tariff rates while Canada’s tariff rate jumped from 25% to 35%.

Although agreements were finalized with Japan, South Korea, the UK and the EU, global investors still reacted cautiously. Asian equity markets declined in response and crypto markets followed suit. The tariff rollout also arrived alongside silence from the Federal Open Market Committee (FOMC) on interest rate cuts.

The lack of clear monetary policy direction contributed to the unease of the investor in both the traditional and digital markets. Adding to the pressure, the U.S. dollar index (DXY) fell, which indicates a high uncertainty in the macroeconomic situation. The downturn in a dollar did not favor risk assets such as Bitcoin which on the contrary, thrives on a weaker dollar.

Regulatory uncertainty is another factor weighing on the market. Despite the release of a crypto-friendly policy report this week, clear timelines for ETF approvals remain elusive. The SEC’s new listing standards could open the door for altcoin ETPs, but investors remain cautious. Stablecoin framework legislation is also stalled in Congress, adding to broader uncertainty for institutional participation.

Related: Bitcoin’s Power Shift: Whales Exit, Institutions Step In

$630M in Liquidations Signal Market Shakeout

The sell-off triggered widespread forced liquidations across crypto markets. According to CoinGlass data, over 161,000 traders were liquidated in the last 24 hours, totaling $632.6 million. Most of the liquidations were long positions, highlighting how leveraged bullish bets were wiped out as prices slid.

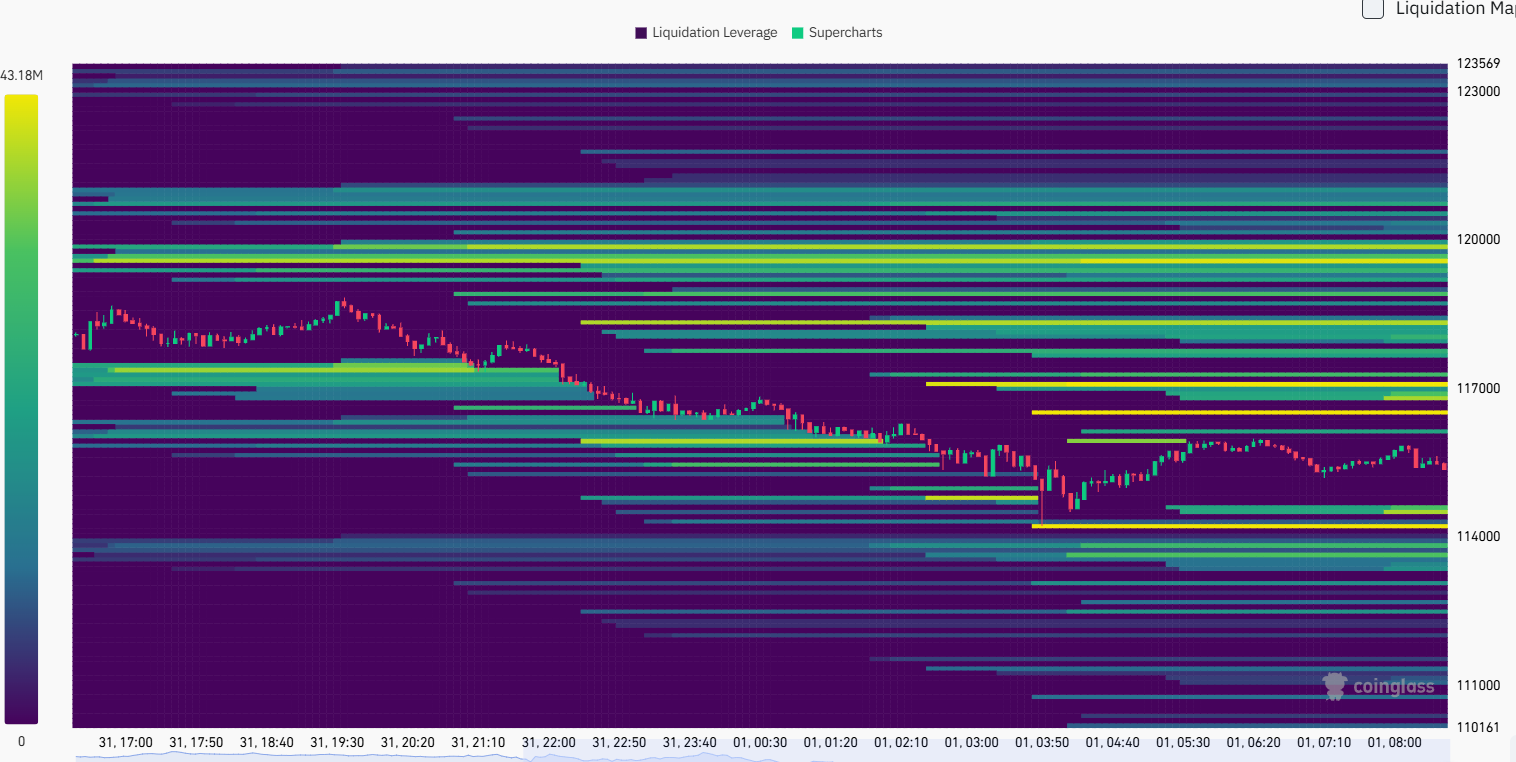

Binance’s liquidation map showed strong long liquidation pressure between $113,000 and $115,000. A large concentration of leveraged positions between $117,000 and $123,000 adds further downside risk if no recovery follows.

Meanwhile the support zones are currently around $111,000 and $114,000, where the liquidation risk is less concentrated. The price of Bitcoin is stuck in a narrow range, trading around $115,300, with the resistance at around $117,000.

Source: Coinglass

The market outlook is still tense in the short term as volatility persists. Altcoins fell also as the sentiment shifted towards risk assets. Ethereum, Solana and BNB posted losses between 3% and 5% over the same period. Total crypto market cap dropped by more than $110 billion over the last 12 hours.

Despite Friday’s drop, Bitcoin closed July with its highest monthly close ever at $115,790, according to TradingView. The largest monthly candle is notably around Trump’s victory for his second innings as President, and that surge contrasts with today’s cautious tone, even amid strong long-term momentum.

The current sell-off could be a shakeout. Market participants are likely to remain defensive until more macro and regulatory clarity emerges. The leverage is also high and it remains probable to expect more volatility in the days to come. The path forward may depend on how quickly trade and monetary policy stabilize in the coming weeks.

The post Bitcoin Price Drops Amid Tariff Tensions and Fed Silence appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are undergoing a “purification” that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.